940 Form Download

Filing your taxes correctly is crucial, and having the right forms is the first step. If you need to complete the FUTA document, our website simplifies the process of obtaining the printable 940 form for 2023 in PDF format. Follow these detailed instructions to download and complete the form.

Accessing IRS Form 940 in PDF Format

To start the process, navigate to our website's homepage. From here, you can easily locate the IRS Form 940 for 2023 in PDF via the menu or the features available on the home page.

- Upon opening our homepage, look for the menu bar or use the search feature to find the IRS Form 940 for the tax year 2023.

- Once you have located the document, you will see a "Get Form" button that is clearly displayed. Clicking this button will take you to the 940 form in PDF for 2023 that you can fill out electronically.

Downloading the 940 Tax Form

- After clicking on the "Get Form" button, a new window will pop up with an option to download the form. Look for the arrow button, which, when clicked, initiates the download process.

- You will then be prompted to choose the PDF format for the file. It's essential to ensure you select PDF to maintain the correct layout and compatibility with PDF readers when filling in the form. During this step, you will also choose the location on your device where the form will be saved. You may select your desktop, a specific folder, or downloads - wherever convenient for file retrieval afterward.

- Once everything is set, submit your choice and wait a few seconds. The download should start automatically, and the form will be saved to the location you have specified on your device.

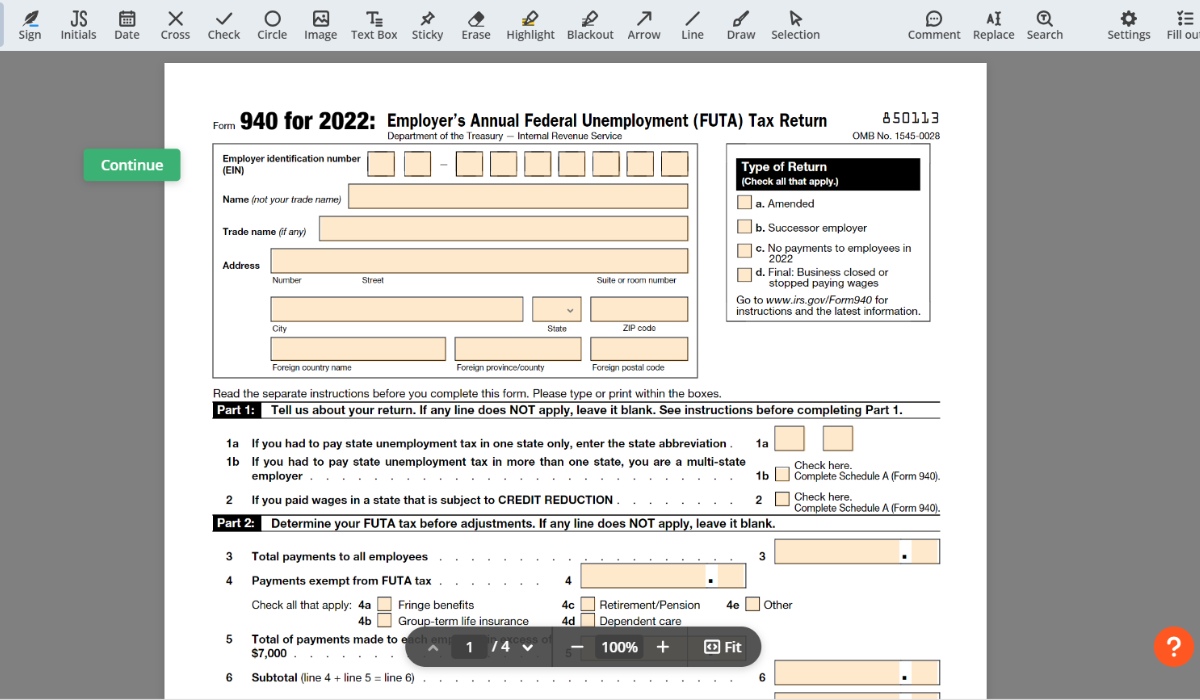

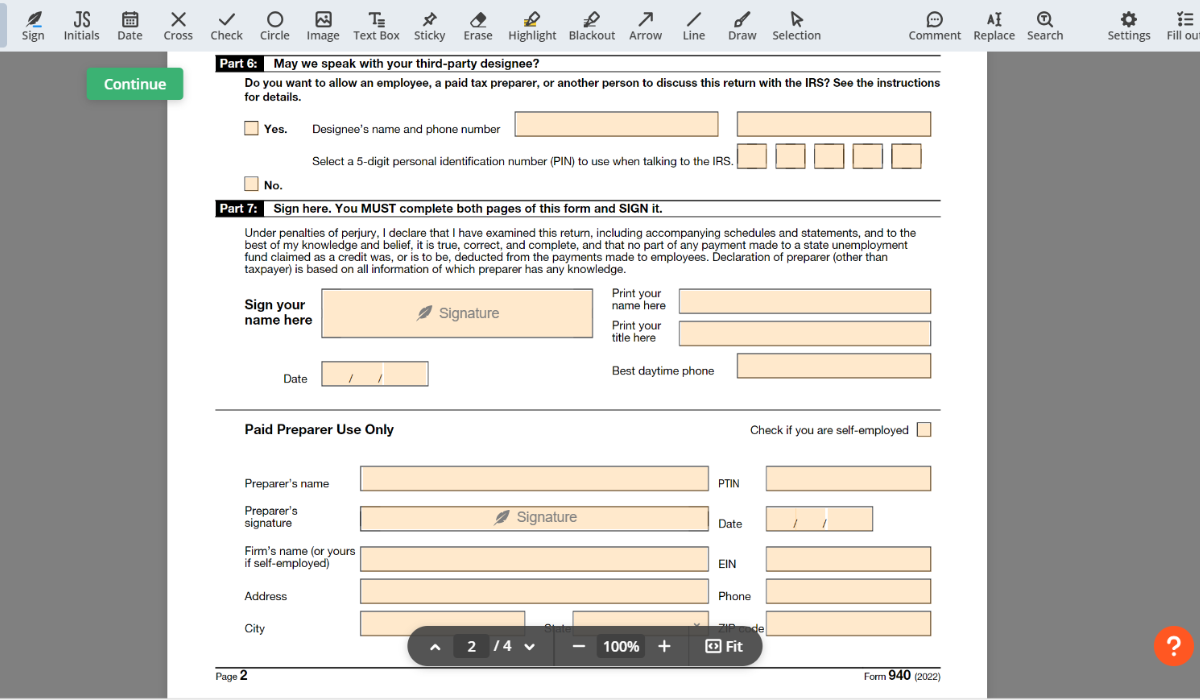

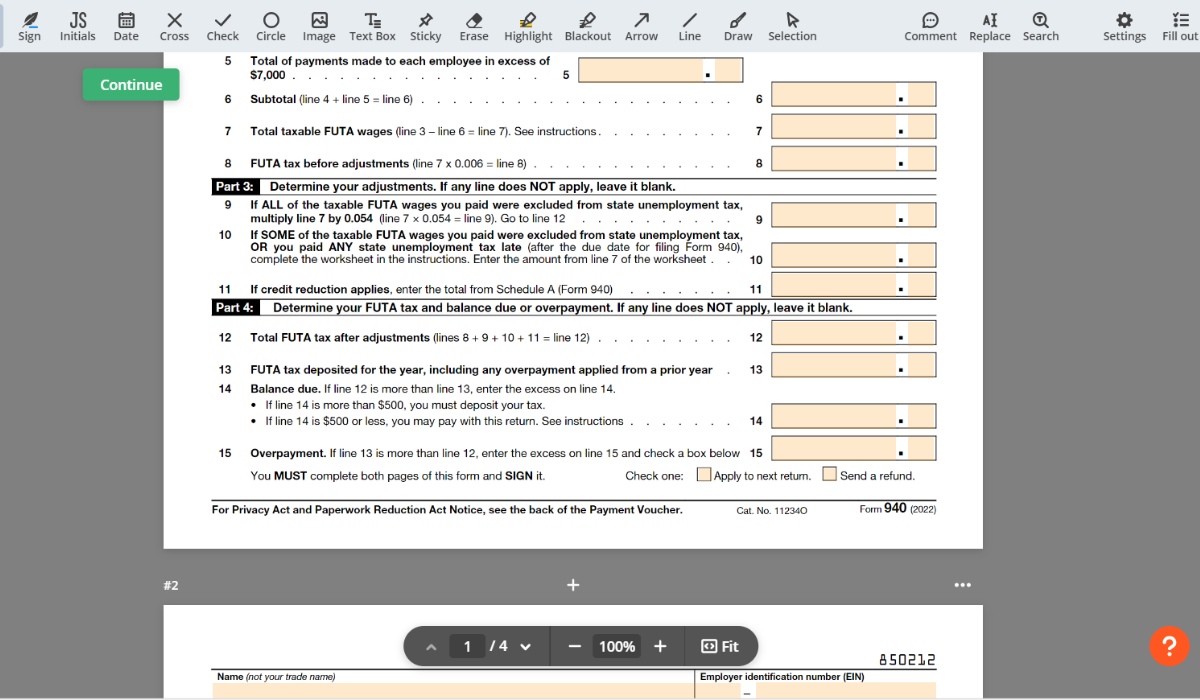

Filling Out IRS Form 940 for 2023

After successfully obtaining the 940 instructions in PDF, take some time to read through them thoroughly before filling out the form. These instructions are included to help you accurately report your annual Federal Unemployment Tax Act (FUTA) tax.

To complete the form:

- Fill out each section according to the directions provided in the 940 instructions. This information will include your EIN, business name, address, state unemployment contributions, and your FUTA tax liability calculation.

- Ensure that you accurately calculate the amounts due, and remember to include any payments already made throughout the year.

- Once you have completed the form, re-check all the details. Any errors made in reporting can result in penalties or a delay in processing.

- Print the completed form if you prefer to mail in a paper copy, or you can file electronically, depending on the options provided by the IRS.

Finalizing the Process

With the completed 940 form in PDF for 2023, you're all set to submit your FUTA tax details to the IRS. Remember, filing an accurate and timely report is important to avoid any potential interest charges or penalties. Consulting with a tax professional may be beneficial if you encounter any difficulties or have questions about the form.