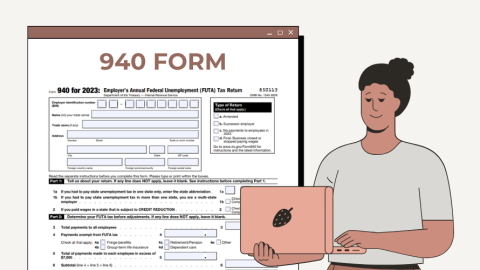

Form 940 for 2023

The 940 form by the IRS is an essential document for employers as it pertains to the reporting of their annual Federal Unemployment Tax Act. Each year, employers who compensate their employees are typically required to file this form, which contributes to the federal government's unemployment fund. This fund is then allocated to states to provide unemployment compensation to workers who have lost their jobs.

In 2024, Form 940 will continue to serve this crucial role. It is crucial that employers understand any adjustments or alterations to this form compared to previous filings, ensuring compliance with internal revenue regulations. Form 940 calculates the employer's federal unemployment tax liability while also reporting the amount of FUTA tax the employer has already paid during the year. This difference will determine if the employer owes additional taxes or is eligible for a credit.

Details Captured on the 940 FUTA Form

It's important to mention that the 940 FUTA tax form for 2023 captures a range of information, including the following:

- total amount an employer paid to employees,

- the FUTA taxable wages,

- any adjustments for state unemployment contributions.

Taxpayers should be attentive to these details, as inaccuracies can lead to underpayment or overpayment of tax liabilities. Further, failing to comply with the appropriate reporting standards might attract penalties or interest.

IRS Form 940 for 2023: Changes and Updates

Each year, updates to tax forms and instructions are possible due to changes in tax law, inflation adjustments, and other policy reasons. As we approach the filing period for the 940 tax form for 2023, taxpayers should monitor reliable resources or consult a professional advisor for any updates or changes that may affect their reporting. To date, such updates are yet to be announced, and as such, employers should prepare based on existing guidelines but remain vigilant for any changes that may be issued by the IRS.

Significant Deadlines for Form 940 Filing

Timeliness in tax filing is critical to avoid penalties. Typically, the deadline for submitting federal form 940 for 2023 is January 31st, 2024. In instances where an employer has deposited all the due FUTA tax on time, the IRS may extend the deadline.

Employers looking for the 940 form for 2023 in PDF can conveniently obtain it from the official IRS website. This user-friendly format allows for easy filling out and printing, streamlining the process of compliance.

Notable Exemptions for the 940 Form and Considerations

Certain types of employment and employers may be exempt from FUTA tax. Understanding these exemptions can be beneficial, potentially reducing a taxpayer's overall liability. Specific conditions could also influence an employer's obligation under FUTA, such as credits received from state unemployment taxes paid.

As a rule of thumb, obtaining a blank 940 form for 2023 ahead of time enables employers to familiarize themselves with the required information and collate it beforehand, ultimately reducing the risk of errors or omissions in their submission.

Precision and education are paramount when navigating the complexities of personal tax matters, such as filing Federal Form 940. Employers should ensure they remain informed of any updates for the 2023 tax year and approach the filing with a clear understanding of deadlines, exemptions, and requirements. It is also advisable to consult with a tax professional for personalized advice tailored to a taxpayer’s unique circumstances.

Latest News