IRS 940 Printable Form

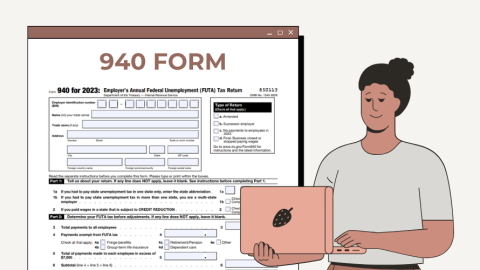

Form 940 is an essential document used to report the annual Federal Unemployment Tax Act (FUTA) tax. This form is filed by employers who pay wages to employees and are subject to state and federal unemployment taxes. It helps calculate the amount of unemployment tax an employer must pay, offering a credit for state unemployment taxes that have been paid. Before you dive into completing the printable tax form 940, it is crucial to grasp its structure and the primary fields it contains:

- Employer Information

This section requires your business's identification details, such as the Employer Identification Number (EIN), name, and address. - Part 1: Here, you report the FUTA tax before adjustments. You'll need to indicate the total amount of payments made to employees during the year.

- Part 2: It is meant for adjustments that can include exempt payments and credits for state unemployment contributions.

- Part 3: In this section, calculate the total FUTA tax after adjustments.

- Part 4: This is where you note down any FUTA tax deposited for the year, including any overpayment.

- Part 5: Finally, this area is designated for any household employees you may have, if applicable.

- Part 6: This optional part of the IRS 940 printable form includes authorization to discuss this return with a third party, such as a tax preparer.

Guidelines for Blank 940 Tax Form Completing

- Ensure all employer information is accurate and matches other tax documents.

- Total up all wages paid throughout the year and only include what's subject to FUTA tax.

- Calculate adjustments precisely, and keep detailed records to support your calculations.

- Verify state unemployment tax payments to apply correct credits to your FUTA liability.

- Cross-check the total tax after adjustments against the deposits made throughout the year to find out if you owe additional tax or are due a refund.

Filing Your Completed Form 940 to the IRS

Once you have the printable Form 940 for 2023 filled out, filing it is the next step in the process:

- Download the Form

Access the free printable IRS Form 940 from our website to ensure it is the correct version for the filing year. - Review Information

Double-check all entered information for accuracy to prevent any errors that could lead to penalties. - Payment

If you owe additional tax, arrange for payment. If you've paid too much, calculate your overpayment for a refund or apply it to next year's return. - Filing

You may file electronically through the IRS e-file system or mail the printed form to the appropriate address provided by the IRS. - Record Keeping

Keep a copy of the filed document and any payment records for at least four years after the due date for filing the return or after the date the tax was paid, whichever is later.

940 FUTA Tax Form for 2023 & Filing Deadline

The deadline for filing Form 940 is typically January 31st of the year following the reported year. This means for the tax year 2023, the deadline would be January 31, 2024. If you made all FUTA tax deposits on time, you may have an extended deadline to file; however, it's critical to stay updated with the IRS for any changes in the filing deadlines.

To alleviate any confusion or concerns with print Form 940 and its filing, always check currently applicable instructions provided by the IRS or consider seeking professional advice. With every piece of information on hand and correct, fulfilling your tax obligations can be a smooth and straightforward task.

Latest News